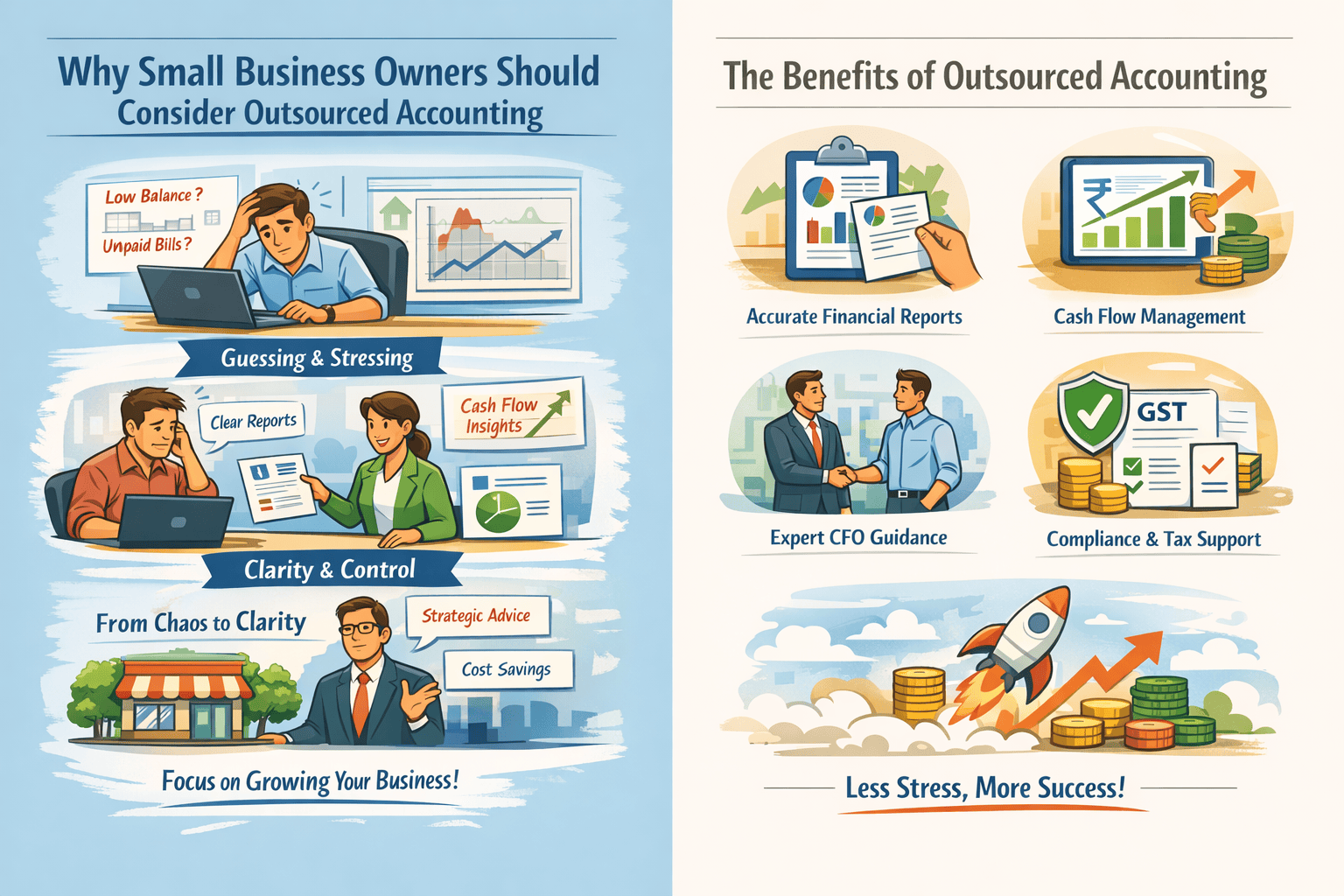

We still hear stories from business owners about the early days, how checking the bank balance was the first thing in the morning and sometimes the last thing at night. Not the reports, not profit statements, just the balance. If it looked okay, there was a small sense of relief. If it didn’t, the whole day felt heavy. That’s how many of the small business owners we work with start out, running on instinct rather than insight.

As the business grows, that quick glance at the bank isn’t enough. Payments move faster, work piles up, and suddenly money feels tight even when sales are good. That’s usually the point when owners realize they cannot manage everything alone. Outsourced accounting is not about giving up control. It is about gaining clarity, peace of mind, and support, so you can focus on growing the business instead of chasing numbers.

Working Hard but Feeling Stuck

Many small businesses are not failing. Orders keep coming, clients pay, teams are busy, yet owners often feel unsure every month.

The problem is not effort. It is not knowing exactly what is happening with money.

When accounts are updated late or only checked during tax season, surprises happen. Cash runs low unexpectedly. Compliance notices shock you. Decisions feel risky because you are guessing rather than seeing the full picture.

When accounting is handled properly, that changes. Clear, timely reports replace guesswork. Owners see patterns and trends, understand which clients are profitable, and spot expenses that are creeping up. GreenInk Consulting LLP helps business owners turn confusion into clarity and make smarter choices without stress.

Accounting That Does More Than Numbers

Outsourced accounting today does much more than just recording transactions. It manages the entire financial workflow, including tracking money coming in and going out, paying vendors on time, reconciling bank statements, monitoring expenses, and preparing easy-to-understand management reports.

Instead of scrambling for numbers, business owners receive clear summaries in time to make decisions. The focus shifts from keeping up to understanding and planning. Accounting stops being a chore and starts being a tool that helps the business grow.

Virtual CFO: Guidance for Small Businesses

As businesses grow, numbers alone are not enough. Owners need someone who can read between the lines and guide strategy. That is where a virtual CFO comes in.

A virtual CFO helps with cash flow forecasts, advice on spending, hiring, and investment, identifying where costs can be trimmed and where growth can accelerate, and long-term planning.

With this support, business owners no longer guess the next steps. They see the picture clearly. Decisions become fact-based rather than gut-based. Growth feels intentional, and confidence grows because owners know what is ahead.

Safety and Compliance

Handling finances in-house comes with hidden risks. Files can get lost, mistakes happen, and rules keep changing. In India, GST, tax filings, and other regulations evolve constantly, which can overwhelm small teams.

Outsourced accounting ensures timely and accurate submissions, compliance with the latest regulations, and proactive monitoring of rule changes.

With a trusted partner, deadlines are met, errors are minimized, and stress fades. Owners do not lose control. They gain reliable systems that protect the business.

Cost: Efficient Support

Many business owners assume outsourcing is expensive. Running an in-house accounting team is often costlier. Salaries, software, training, and employee turnover add up quickly.

Outsourcing provides access to a team of experts without the overhead. Owners get number crunchers, compliance specialists, and financial planners all in one at a predictable cost. The support is consistent and reliable.

Tech-Enabled Accounting

Digital tools make modern outsourced accounting faster and more accurate. Reports update in real time, errors are flagged quickly, and collaboration with auditors is smoother.

Owners get instant visibility into their financial position. Planning becomes easier, and errors are less likely. Accounting becomes simple, clear, and actionable.

Growing Your Business Without Growing Stress

As businesses expand, accounting needs grow too. Simple bookkeeping evolves into managing multiple accounts, preparing detailed reports, and planning strategy.

An outsourced team grows with the business. Expansion does not slow down operations because the financial side is already set up to adapt. Owners can add services, enter new markets, or hire staff without worrying that accounting cannot keep up.

Choosing the Right Partner

Not all providers are the same. The right partner understands the realities of small business, provides clear, timely updates, maintains compliance, and offers long-term support rather than one-off fixes.

A good partner feels like part of the team. GreenInk Consulting LLP works with MSMEs to help owners move from just tracking numbers to making decisions with confidence.

When Things Go Wrong

Every business faces surprises, like missed payments, notices, or mismatched accounts. A trusted accounting partner makes emergencies manageable.

GreenInk Consulting LLP knows the accounts and history of the business. When problems arise, the team steps in quickly, reduces stress, and keeps operations running. Having someone to rely on turns a panic situation into a manageable task.

Conclusion: Focus on What Matters

Running a business is hard work, but it does not mean carrying every burden alone. Outsourced accounting provides clarity, control, and support, allowing owners to focus on growing the business.

With full workflow management, virtual CFO guidance, tech-enabled reporting, and emergency support, owners get more than just numbers. They get a partner who helps the business move forward with purpose.

With the right support, like GreenInk Consulting LLP, accounting stops being a source of stress and starts driving growth.